Highlights

On 15 April 2024, The Inland Revenue Authority of Singapore (IRAS) announced that it will implement a phased adoption of InvoiceNow for GST-registered businesses starting from November 2025.

The adoption of InvoiceNow for invoice data submission to IRAS, extends the traditional four corner e-delivery model to a fifth corner. The overall system design includes funneling copies of live invoices over InvoiceNow, and also invoice data extracted from invoicing systems, to IRAS system.

The technical specifications “Invoice Data Submission Specifications for IRAS GST InvoiceNow Requirement” is now available for service providers and GST-registered businesses to plan the enhancement of their systems.

The technical specification comprises of:

TX1 – Design Document

Overall system design

TX2 – Data Extraction and Transformation

Enhancements required for systems for both market solutions and GST-registered businesses

TX2 - Data Extraction and Transformation

TX2 - Annex - Data Specification

TX3 – Access Point Services

Enhancements required for Access Points

TX3 - Access Point Services Release

C5 Testing Resources

C5 Testing Resources for Access Point Providers (APs)

C5 Testing Resources for InvoiceNow Ready Solution Providers (IRSPs)

Enhancements made to InvoiceNow

Two new business document types are enabled on the InvoiceNow Network

- Purchase Order – This allows buyers to be able to send an e-order document to the suppliers from system to system without human intervention. With the order data residing in the supplier system, they can convert the order data into an e-Invoice to be sent back to the buyer over the network, thus saving data entry efforts and improving data quality needed by the buyers to match invoice and order. This helps to speed up processing and payment to the suppliers.

- Invoice Response - This is a document from buyers to suppliers providing a status update of the suppliers’ invoice on the buyers’ system. Through this, suppliers will be informed of the invoice status, hence automatically reducing time-consuming follow-ups with their buyers and unnecessarily risking customer satisfaction.

The support for these new documents has been made mandatory for all IMDA Accredited Access Points since April 2024. All IMDA Accredited Peppol-Ready Solution Providers offering solutions that connect to the network are required to support the receipt on these documents through the network from April 2024.

Peppol International (PINT) Specifications

PINT is the next generation Peppol data standard for e-invoice enabling us to experience seamless cross-border transactions.

This new data standard will allow our businesses to:

- Send e-invoices to overseas customers as if you are sending to someone local

- Receive e-invoices from oversea suppliers with choice to invoke customized workflow

IMDA has made this data standard available in early 2024 and is currently in the process of enhancing the network and participating systems to fully support PINT. Neighbouring countries (Australia, Japan, Malaysia, and New Zealand) using Peppol are set to support PINT in the same time period, with countries in Europe joining in the adoption. With more countries supporting Peppol adopting PINT, businesses will benefit from more seamless cross-border invoicing.

PINT will also be the base data format used to support IRAS’ GST data submission.

BIS 3.0 Specifications

Peppol Business Interoperability Specifications (BIS) is developed in Europe for the eProcurement processes to standardise electronic documents exchanged between sending and receiving Access Points (AP). In Singapore, the BIS 3.0 specifications are used for Invoice Response and Purchase Order.

- Replacement of VAS (Europe) to Singapore’s GST (Goods and Services Tax) and to cater for non-GST registered businesses;

- Specific GST calculation and rounding steps for presenting amount in invoices

- Update of GST code list value to identify the specific GST categories available to use; and

- Singapore specific payments such as Direct debit using GIRO and Credit Transfer using Unique Entity Number (UEN)-based PayNow Corporate

For more information on the BIS 3.0 specifications, please click on Singapore Peppol Guide.

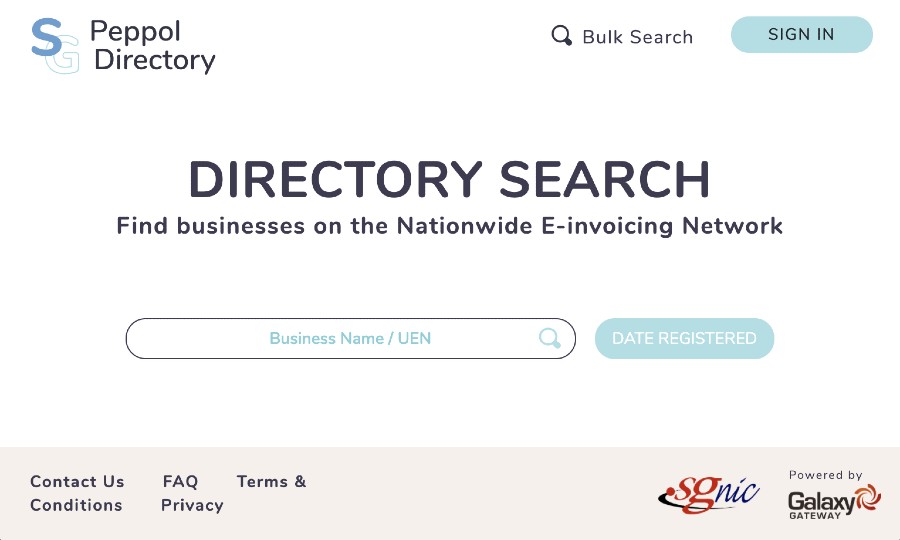

SG Peppol Directory

The SG Peppol Directory is a facility for searching Singapore businesses registered on the nationwide e-invoicing network. The SG Peppol Directory allows businesses to search for other companies registered on the Peppol network to send and receive e-invoices electronically through the nationwide e-invoicing framework. This includes e-invoicing solution providers, who provide software and services that enable businesses to create, send, receive, and process e-invoices in compliance with the Peppol standards.

Watch the video guide below:

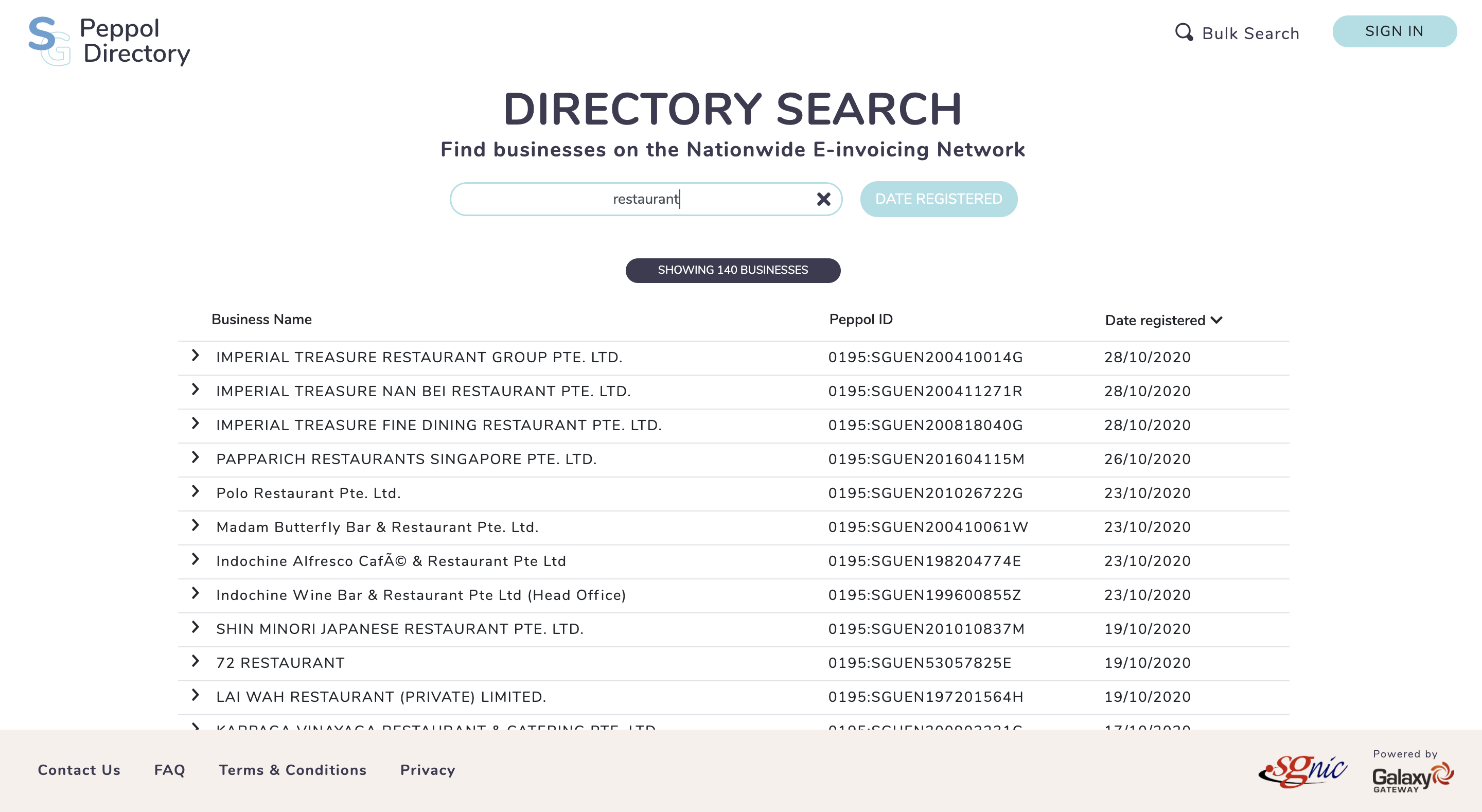

Simple search function

Perform a simple search for Singapore businesses who are registered on the Peppol network using their company name or UEN.

Successful searches will showcase all relevant companies with their full name, Peppol IDs, and the type of Peppol document they can receive.

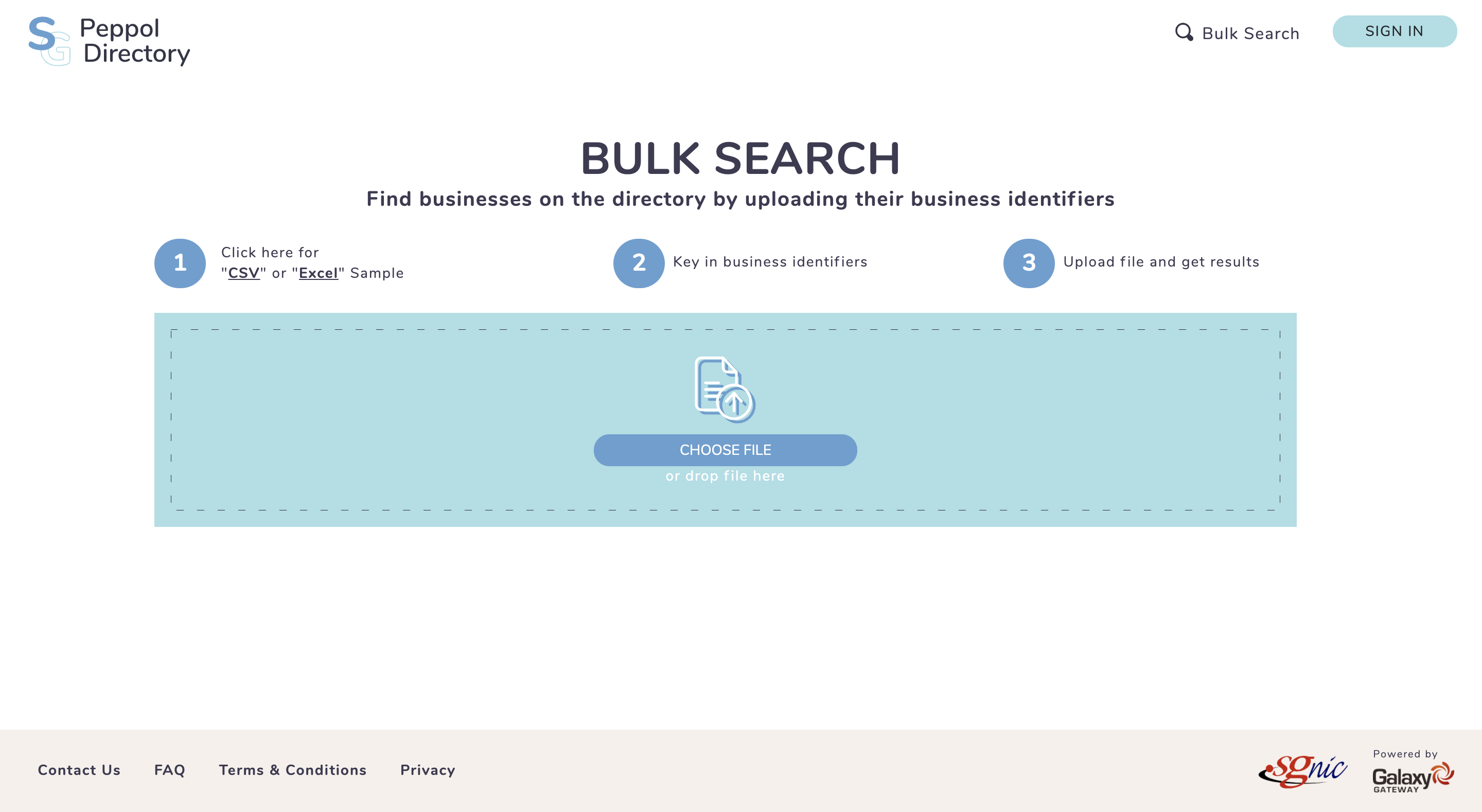

Bulk search function

Perform a single search of multiple companies using the bulk search feature. Simply upload a CSV or Excel file containing the list of UENs of companies and the result of the search will be downloaded automatically with the company names, Peppol IDs, and type of Peppol documents supported.

Registered accounts on SG Peppol Directory

Registered business users on the platform will be able to access the following features:

- Download the entire SG Peppol Directory in CSV format

- Set-up an API connectivity to the platform to carry application initiated UEN searches

For any questions regarding the SG Peppol Directory, please drop an email to support@peppoldirectory.sg

4-Corner Model explained

Below is an explanatory video of how the 4-Corner Model concept, also known as the Peppol e-delivery concept, helps to deliver business documents such as e-invoice on the Peppol network (also known as InvoiceNow).

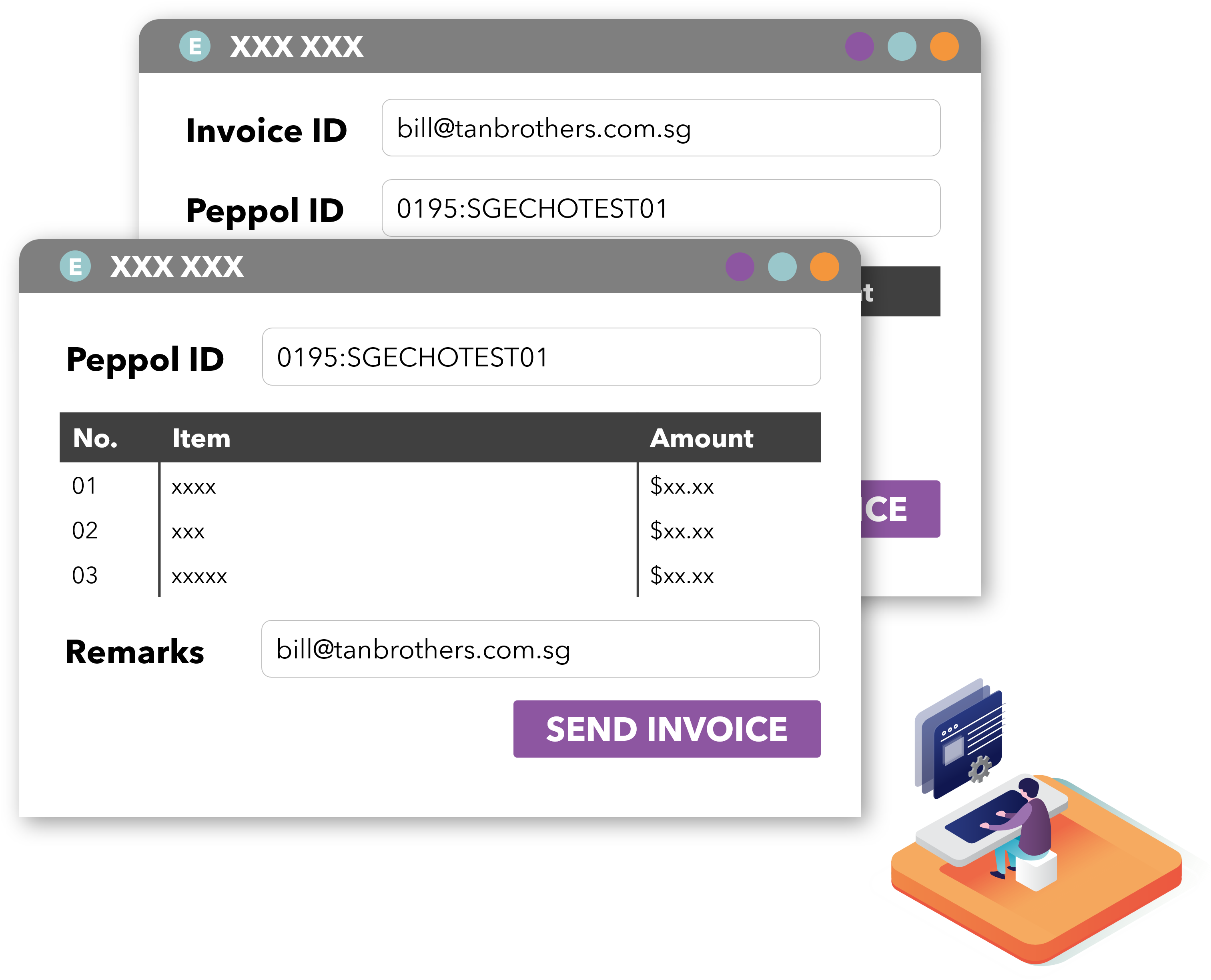

How to send a test e-invoice

Businesses on the network can send a sample e-invoice to the specially arranged “Echo” recipient on network. This is a special account, where the receiving system will “bounce” the incoming invoice back to the sender through a specified email address.

Instructions

Create and send a e-invoice to

Peppol/ Recipient ID:

- 0195:SGTSTECHOTEST01 (Courtesy of eInvoice.sg (UnifiedPost))

- 0195:SGTSTECHOTEST02 (Courtesy of DataPost)

- 0195:SGTSTECHOTEST03 (Courtesy of Activants)

Enter the return email address to which the invoice

should be bounced in either the:

- Invoice ID/No field, or

- Remarks/Notes field

Validex tool

The Validex tool is free to use for checking whether the supported electronic documents exchanged over the Peppol network are compliant to the Singapore’s localised specifications. Click here for the Singapore Peppol Guide to access the supported electronic documents.

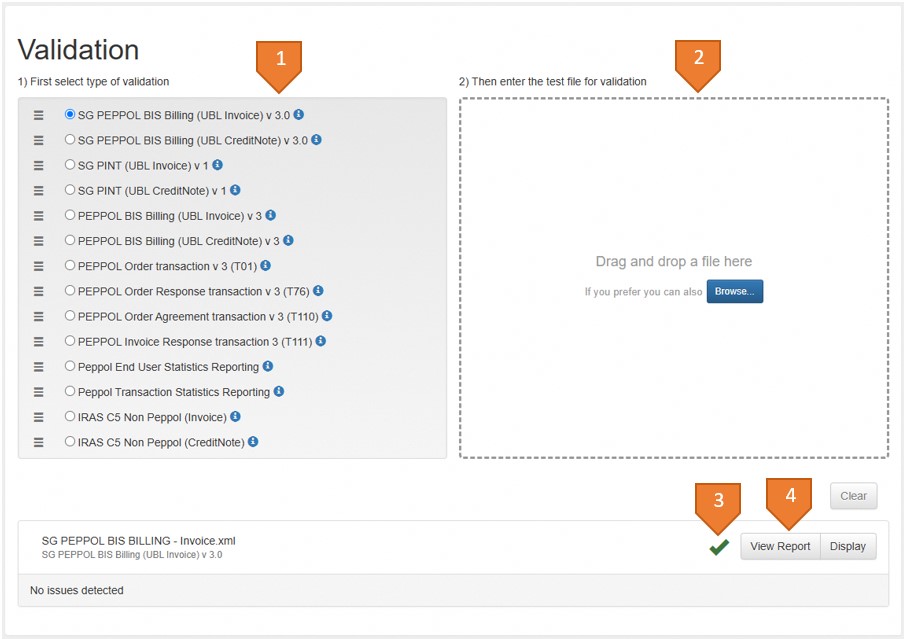

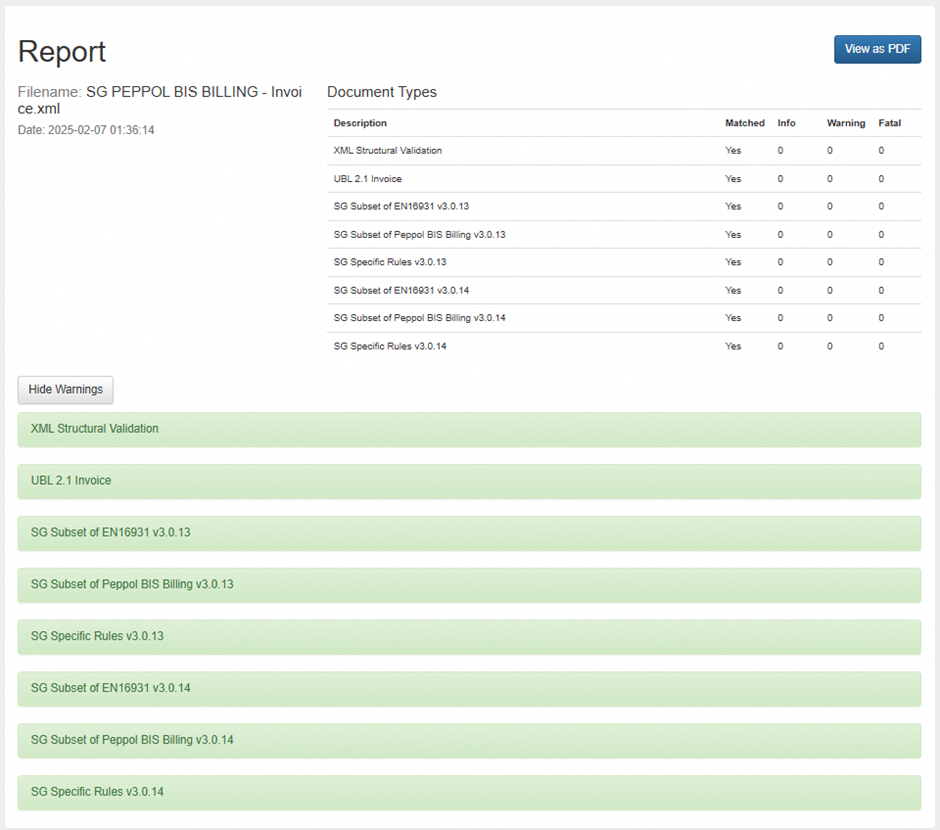

Below are the steps for using the Validex tool.

- Select a document type.

- Upload the XML file of selected document type.

- Validation status will be shown after successful upload.

- Select the “View Report” button for detailed results.

Click here to access the free Validex tool to validate your electronic documents against Singapore’s localised specifications.

.webp)